BuiltUp

Ventures

BuiltUp

Ventures

BuiltUp

Ventures

BuiltUp Ventures (BUV) is a seed investment fund specializing in early-stage, early revenue, property, construction, and smart city technologies. Our 360-degree business model addresses every stage of Corporate Real Estate. With extensive experience in real estate and a large global network, we provide access to innovative investment opportunities in property technology.

At BuiltUp Ventures, we do more than just invest money in Property Technology. We use our vast resources and experience in go-to-market strategy and strong U.S.-based business development team, to accelerate our portfolio companies value.

Our business relationships create partnerships, integrations, business development initiatives, and strategic alliances. Additionally, these integral connections can improve the position of our portfolio companies for acquiring Round A investments, and may even remove the need for additional seed funding.

We are partnered with leading IP firm Cohn, de Vries, Stadler & Co., which provides value to our Property Technology portfolio companies.

Our team and network have years of experience in seed to Round A funding. Moreover, BuiltUp Ventures has access to many leading innovative players in global hi-tech.

Technology to monitors the cleanliness of restrooms, boardrooms, kitchens, and other facilities.

Founder - Ran Sinai, CEO/Founder; Avi Anais, CEO; Israel Barell, VP Customer Service; Boaz Avni, CTO

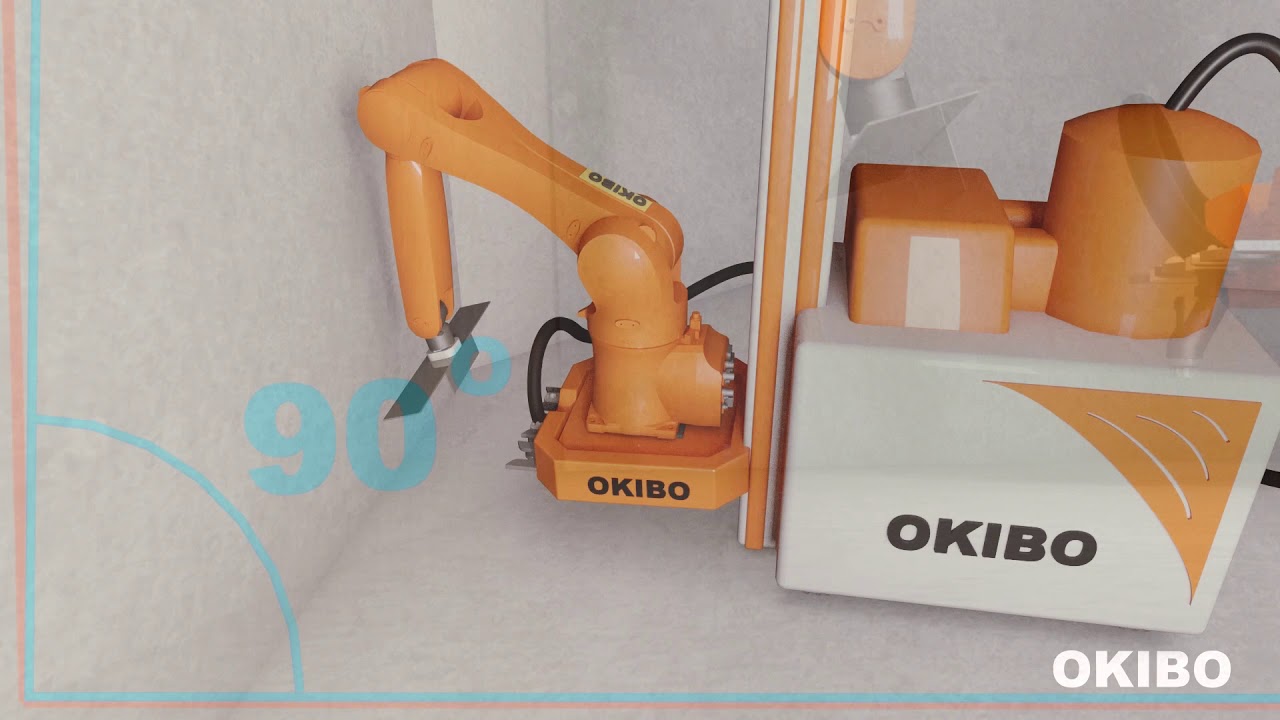

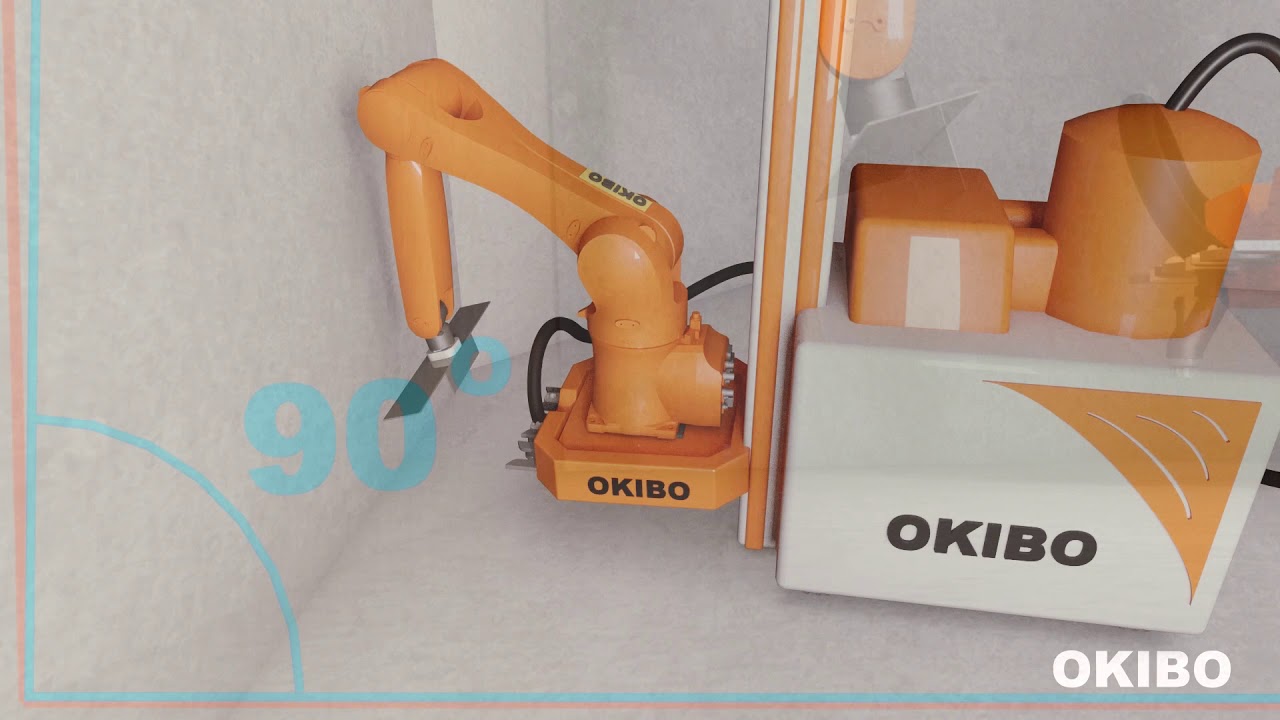

Okibo develops smart, autonomous, robots for construction sites.

Founders: Guy German, Nadav Shuruk

3DCOM creates 3D models from 2D architectural plans.

Founders: Ron Cohen, Avi Cohen, & Sagi Hirsh

Augmented Reality (AR) for real estate.

Founders: Ran Keren, Yuval Gloz

Autonomous water leak detector for preventing costly damages.

Founders: Uri Sokolov, Yaniv Frydman

BuzzzTech uses advanced sensors, loT, and Al to manage restrooms, kitchens, boardrooms, and other environments for hygiene and cleanliness. In high-traffic areas, restrooms are particularly difficult to keep clean. Unsanitary conditions often lead to complaints and decreased productivity. Moreover, restrooms need to be well-stocked with soap, paper towels, and other essentials. And when things break down, they need to be repaired right away. BuzzzTech’s real-time data identifies problems and manages how to properly allocate resources for specific tasks. The results are improved customer/employee satisfaction, fewer complaints, better productivity, and significant savings. Over the past five years, leading companies have used BuzzzTech and they are praising their solutions. The technology is ideal for any type of facility, including malls, airports, offices, and hospitals. Find out more about BuzzzTech today! https://buzzztech.com/

Okibo’s autonomous, intelligent, robots reduce construction costs and improve efficiency. Using advanced computer vision, laser detectors, geo-positioning, and inertial motion sensors, they easily integrate with construction sites to perform tasks that were previously performed manually or with limited-function machinery. Find out more about Okibo’s innovative autonomous robots: https://okibo.com/

3DCOM creates professional 3D models from 2D architectural plans. Statistics show that customers are increasingly using virtual online tours to buy properties. Moreover, many buyers prefer realtors with websites that provide virtual tours. The problem is that traditional architectural plans don’t show what a property will truly look like. 3D visualization can convey depth, space, and perspective, enabling clients to see what a property looks like before construction.3DCOM is leading the way with Proptech for the 21st century. Find out more about their unique platform: https://www.3dcom.io/

Augmind enables Augmented Reality developers to quickly create realistic digital content that runs seamlessly on mobile devices. These capabilities can be a game-changer for the rapidly modernizing real estate and property technology sectors. To find out more about Augmind: https://augmind.me/

Watrix detects water leakages and prevents costly damage expenses. With an internal 3-year battery pack and SIM, it works without an electrical socket, internet connection, or WIFI. Their smart AI algorithm quickly and accurately detects abnormal water usage, and immediately sends out alerts. Find out more about Watrix’s solution for preventing water damage: https://watrix.io/

Digitalization for purchasing construction materials.

Founders: Arik Davidi, Or Lakritz

Decentralized investment banking platform connects global brokers & investment banks.

Founders: Yael Tamar, CEO & Co-Founder

Command & control solutions for the construction industry.

Founders: Omri Sorek, Ofer Simon

An intelligent property management platform.

Founders: Pini Shemesh, Amit Giladi

Autonomous drone landing for unattended sites.

Founders -

Idan Shimon, Amnon Demri, & Or Epstein

AI-based, dynamic, unmanned traffic management.

Founders -

Eyal Zor, Yair Yosef, & Shai Kurianski

DIBS Capital is the first decentralized investment banking platform with a Web-3 powered affiliation system connecting global brokers and investment banks. This smart wallet system creates fast, inexpensive, compliant securities distribution https://dibscapital.com/

Trusstor’s construction site management platform creates safer, more productive, working environments. Their command and control dashboard provides real-time status, enabling quality data gathering and utilization for decision-making. Led by professional domain experts and leading tech minds, their technology assists site management without creating overhead. To learn more about Trusstor’s simple solutions for complex problems. https://trusstor.com/

MyTower’s all-in-one, facilities management platform addresses the complex issues facing today’s real estate managers. It is the first Proptech company to adopt smart tech for property and service management solutions. https://www.mytowerapp.com/

Wonder Robotics enables vertical take-off and landing (VTOL) drones to safely and autonomously land on any unattended site. It was founded by global experts in drone technology, robotics, navigation, and 3D visualization applications for commercial and military markets. https://www.wonderbotics.com/

Eliezer Gross

Chairman, Investment Committee Member

LinkedinEliezer is the Founder and CEO of Besadno Investment Group, with forty years of international business experience in North America, Europe, Asia, and Africa. Under his leadership, Besadno has invested in close to fifty companies. He has taken an active role in many of these ventures. Eliezer believes in the Jewish principle of “siyata dishmaya” (a term that means “with G-d's help”) which conveys the idea that we succeed because of G-d's intervention. Moreover, he has written three books on this concept, which guides his ethical principles in life and business.

Brian Steinberger

Chief Investment Officer (CIO), Investment Committee Member

LinkedinBrian is the founder of Lucent Investments, an investment management firm, and Inner Circle, an investment advisory firm. Previously, he held managerial positions at world-leading financial institutions, including Deutsche Bank, where was the Head of Operations – Equity Trading Desk. Brian studied business management and economics at the State University of New York. He holds FINRA securities licenses in Series 7 – General Securities, and Series 55 – Equity Trader.

Rami Navarro

UAE Regional Director, Director of Business Development, Investment Committee Member

Linkedin

Rami Navarro

UAE Regional Director, Director of Business Development, Investment Committee Member

LinkedinRami has years of experience in sales, finance, marketing, & business operations, including more than thirty years in real estate development and green energy construction. As the CEO of Energy Green Builders Inc. in California, he led the company to financial success. Rami is an ambitious, organizer, and problem-solver. Besides his experience, his varied skills and great attitude, make him an essential asset.

At the VIP Investor Summit, Besadno and BuiltUp Ventures Demonstrated Why Now Is the Best Time to Invest in Israeli Startups

The ongoing war and other economic headwinds have posed a challenge to Israeli companies. However, VC firms Besadno and BuiltUp Ventures successfully demonstrated through compelling presentations and discussions why now is an ideal time to invest in Israeli startups.

The event took place on February 27th, 2024 at the Bison & Bourbon in Brooklyn, New York and featured the Besadno and BuiltUp Ventures team and startup companies engaging in talks, presentations and panel discussions before an audience of present and prospective investors.

The evening began with the discussion “Investing in Israel–Why Now?” Israeli startups are world renown for their advanced innovation and disruptive solutions, but they are also flexible and resilient.

Although the current war with Hamas creates an environment of uncertainty, the technologies of many of the portfolio companies have become not only useful but indispensable as the result of the war.

In addition, Israeli technology aligns investors with innovation that allows them to benefit from the transformation of industries and markets.

The next phase of the event focused on presentations of five portfolio companies AirWayz, BuzzzTech, Microbiome, Wonder Robotics and TempraMed.

AirWayz, is a proprietary Unmanned Traffic Management System (UTM) that uses artificial intelligence and cloud-based software for multi-fleet coordination and flight route optimization.

BuzzzTech is an automated system for keeping public restrooms clean

throughout the day using innovative sensors, intelligent algorithms, and AI-based technologies.

Microbiome’s formula that eliminates harmful bacteria and pathogens by stimulating the reproduction of healthy bacteria has been approved by Israel’s Ministry of Agriculture.

Wonder Robotics’ drone management technology is currently being used by the IDF for the safe landing of its drones. Its Wonderland has an attachable stereo vision pod for ground clearance and a vertical data analytics system for precise and safe autonomous landings.

TempraMed is an FDA-registered, patent-protected, medical device that keeps medications at optimal temperatures in hot and cold environments.

Following the company presentations, there was a networking session during which participants could meet and have in-depth conversations. The enthusiasm was evident throughout the presentations and during the networking sessions, and it was clear that participants were inspired, well-informed and had made lasting connections.

To conclude the evening, Besadno director Eliezer Gross gave an uplifting dvar Torah and all participants engaged in a siyum haShas as a testament to Hashem’s guidance in the success of our investments.

The Besadno VIP Investor summit was not just a one-time event, but a catalyst for future opportunities. The presentations, discussions and connections set the stage for a continued exploration and collaboration in the ever-changing landscape of technology.

Besadno and BuiltUp Ventures extend their appreciation to everyone who contributed to the success of this valuable event.

If you would like to be part of our journey towards creating the future of industries through disruptive technologies, reach out to us at info@builtupventures.com or info@besadno.com.

We look forward to hearing from you and welcome your participation.

Employment and education among ultra-orthodox women, including in tech, is only rising, says a recent Israel Democracy Institute report. This is in part due to initiatives like Ultra-Code, a two-year program that provides haredi women with advanced study and training in technological subjects to help them gain employment in the tech sector

SKYOPS and Airwayz are pleased to announce they have entered into a strategic partnership, combining SKYOPS’ innovative fleet management and flight operations solution with Airwayz’ leading Unmanned Traffic Management (UTM) services. SKYOPS recognizes the importance of seamless integration of UTM within its aviation software solutions. This collaboration enables SKYOPS to enhance its platform’s capabilities by leveraging Airwayz’ expertise in UTM. Together, they are committed to advancing the integration of UTM services, ensuring the safe and efficient management of unmanned aircraft operations.